Shreveport Fiscal Impact Analysis

Why can’t Shreveport afford to fix its ailing infrastructure?

It is common knowledge that Shreveport residents believe our tax dollars are disappearing. This concern has given rise to important questions about where those funds are going. What we do know is that we can't cover the cost of roads, sidewalks, parks, water, and sewer without federal intervention. We can't afford the nice things we believe we deserve and, as a result, we feel overtaxed. Yet, despite these questions, we've never taken a deeper look at where our tax dollars come from and why they cannot pay for what we think they should… until now.

In the summer of 2017, ReForm Shreveport invited our second-ever presenter, Joe Minnicozzi, the founder of Urban3, a private consulting firm specializing in land value economics, property tax analysis, and community design. Just two years prior, Joe had collaborated with our inaugural presenter, Charles Marohn of Strong Towns, on a groundbreaking fiscal analysis of Lafayette which disrupted how the city saw its valuable tax dollars and created opportunities to change how they looked at their infrastructure so they could make sound investments for the future. That analysis uncovered that revitalizing Lafayette’s downtown and dense core communities were vital for economic stability.

Diagnosing the problem with an “economic MRI”

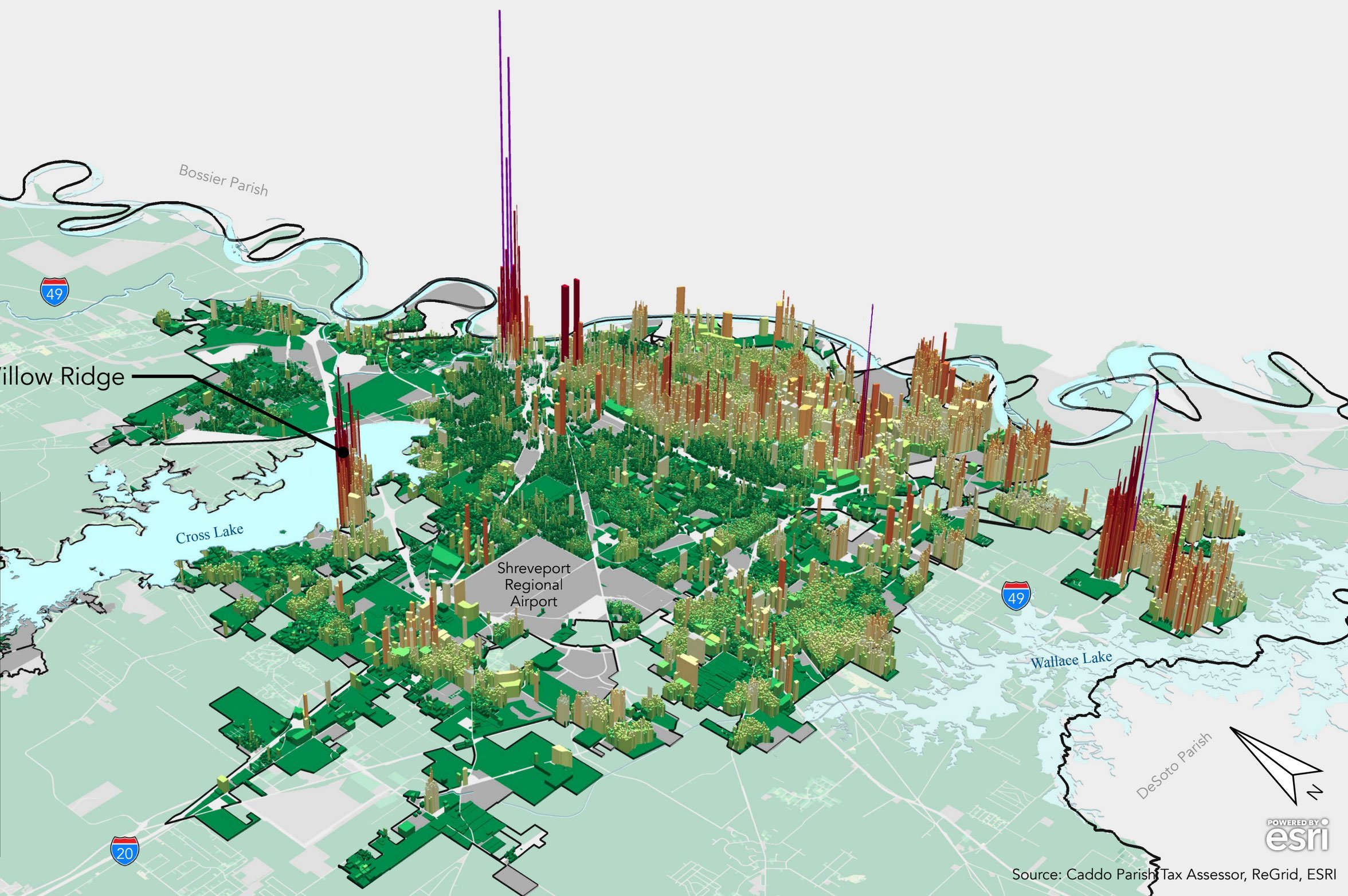

Joe has given hundreds of presentations, sharing stories of small and mid-sized cities suffering from low morale, identity crises, and poor economic outcomes. In his 2017 presentation with ReForm Shreveport, he showed the audience of stakeholders and intrigued citizens stark financial analysis and vivid, three-dimensional charts of various cities depicting the potential of a revitalized downtown compared to suburban sprawl. These cities, like Shreveport, were dotted with hundreds of acres of mostly-empty parking lots, cheaply-built big box retail stores, and car-dependent neighborhoods — all of which, according to his calculations, actually cost the city more money in maintenance than the taxes generated by those developments.

Joe also shared how policy changes, such as loosening certain redevelopment restrictions and restructuring permits, along with an injection of $15 million of local private investment, allowed Asheville to realize significantly more of its downtown's value and increase tax revenue without raising taxes, and become lauded by several national magazines as a top travel destination.

Commissioning a Shreveport-specific fiscal impact analysis

In 2021, Shreveport City Council members had an opportunity to allocate federal COVID funds to special projects. As councilwoman for District B, LeVette Fuller, who is also a founding member of ReForm Shreveport, matched funds with Downtown Shreveport Development Corporation (DSDC) for a community development-led open call for proposals for a city-wide analysis. The process, which received proposals from multiple firms, ultimately resulted in the selection of Urban3 to provide the same kind of analysis they had done in other cities — a "value-per-acre fiscal analysis" of the entire City of Shreveport.

Shreveport Louisiana, USA downtown skyline on the Red River at twilight. Photo by Sean Pavone. Used with permission.

Visualization of the market value for each acre of the city. Data collected from the Caddo Parish Tax Assessor, visualized by Urban3.

Example of the amount of vacant (unproductive) land in Cedar Grove, a core, urban neighborhood in Shreveport.

The mismatch in revenue and expenses has been exacerbated by sprawl, which has added new infrastructure responsibilities in annexed areas where affluent populations are resettling. More often than not, these newly-annexed areas do not generate enough economic activity or property taxes to justify their addition to the city or to pay for repairs to the infrastructure that services them. This ultimately means that dense, productive areas of town, such as downtown are effectively subsidizing suburban development, pulling financial resources away from the core neighborhoods.

Bonds are like credit cards — they make capital available today with interest that must be paid tomorrow. If the repairs or new infrastructure projects we are paying for with bonds do not bring an economic return equal to their cost plus interest, we should reconsider them.

Dense, multi-family homes and multi-story business developments with minimal parking have been deemed to be the most valuable types of development by making the most use of each acre of land with minimal infrastructure requirements. These development types are in line with the Shreveport-Caddo 2030 Master Plan, unlike most suburban developments.

Redline map of Shreveport. Courtesy of University of Richmond, HOLC.

Remove zoning barriers to multi-family homes, small homes, and other dense multi-use buildings to in-fill our legacy communities and use the existing infrastructure to maximize returns to the city’s tax revenue.

Work with local historians, architects, and students to create free, pre-approved home plans for legacy communities to be built with minimal time and cost. These designs should be sensitive to legacy neighborhood historical styles and sensibilities.

Make communities more walkable and conducive to multiple types of transportation (including bicycles and public transit) to reduce dependence on expensive roads and parking lots, which are low-return land uses.

Remove parking minimums which force developers to spend money and use land unproductively.

Open a discussion about de-annexing outlier areas of town that consume more city tax resources than they provide.

Replace the current property tax system with a Land Value Tax (LVT) system that incentivizes redevelopment and disincentivizes speculative land purchasing, leading to underutilized and vacant properties that plague downtown Shreveport and some legacy neighborhoods. We should also consider reducing our reliance on sales tax, as sales tax tends to suffer during economic downturns, which are largely out of our control.

Because we know what infrastructure we have and what needs replacing, create a policy that saves tax revenue for future repairs to be paid for in cash, saving taxpayers from paying interest on bonds for regular maintenance. Reserve bonds only when taking on debt and interest is necessary and unavoidable.

Make all changes with a focus on addressing past wrongs and ensuring that displacement does not take the place of long-time residents of core communities. Be intentionally inclusive of current and potential minority landowners, developers, and residents.

Examples of land value per acre on select downtown Shreveport properties.

Results and public presentation event

The analysis looked at every parcel of land, taking into account its tax value as determined by the Caddo Assessor’s Office along with the sales taxes collected by businesses on those properties and compared it against the infrastructure that had been installed to service that property — roads, sidewalks, water and sewer infrastructure and more. With this data, Joe and his team at Urban3 were able to show which parcels and neighborhoods were capable of returning their cost to the community in taxes and which ones did not. He also analyzed which kinds of buildings and land use were most productive.

ReForm was asked by the City of Shreveport to help organize, host, and to live stream the public presentation of the results of Urban3’s analysis. On Monday, March 13, 2023 Joe Minicozzi spoke about those results at a public meeting at LSUS which was live streamed to ReForm Shreveport’s Facebook page.

The complete presentation video and the accompanying presentation slide show can be found below. Scroll further down for ReForm Shreveport’s summary of the presentation and a list of important action items.

DOWNLOAD THE PRESENTATION

Note: The PDF of the slide show is large (103MB) and has some duplicate slides that were used for purposes of illustration or animation of information during the live presentation.

Key Takeaways

After watching Joe’s analysis, ReForm Shreveport has compiled key takeaways from the presentation that should help focus the conversation:

Shreveport's infrastructure is in a deficit crisis of well over $1 billion and is in dire need of repair in certain areas.

Shreveport's population and tax base is declining and cannot pay for all of the infrastructure repairs that are needed today and that recently-annexed land will require in the not-so-distant future.

We have paved enough lanes of road to stretch from Shreveport to Buffalo, New York — much of which is not being used to generate productivity in the form of property taxes or sales taxes, the latter of which makes up the majority of our tax revenue.

Past choices in public policy, namely redlining rooted in racism and anti-immigrant sentiments, have cost taxpayers by driving disinvestment in core “legacy” communities. Not only has this disinvestment resulted in underutilized land and infrastructure that we must maintain and replace, it also has had negative health and wealth outcomes for the people living in those communities.

Action Items

Looking at the key takeaways, there are some action items that the city should engage in as soon as possible. The sooner that these changes are made, the sooner the city can begin to recover and the sooner it can address its ailing infrastructure and quality of life. Shreveport residents, communities, businesses, and nonprofits should press the City of Shreveport to act quickly on the following items:

Make targeted investments in the construction of dense urban developments — both residential and business-oriented — in areas that have suffered past policy choices that will return more than our investment. This is primarily in previously redlined communities in the city core and west of I-49.